Percentage taken out of paycheck for taxes

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches.

Calculate Taxes On Paycheck Top Sellers 53 Off Www Wtashows Com

You pay the tax on only the first 147000 of.

. If you increase your contributions your paychecks will get. How Your Pennsylvania Paycheck Works. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Elected State Percentage. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. FICA taxes are commonly called the payroll tax.

What is the percentage that is taken out of a paycheck. 1 and continuing through the end of the year. See how your refund take-home pay or tax due are affected by withholding amount.

You can thank payroll taxes for that. The first 3100 you earn in taxable income is taxed at 100. For the 2019 tax year the maximum income amount that can be.

Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee. Add up all your tax payments and divide this amount by your gross total pay to determine the percentage of tax you pay. Adjusted gross income - Post-tax deductions Exemptions Taxable income.

This is divided up so that both employer and employee pay 62 each. Add your details. Taxable income Tax rate based on filing status Tax liability.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. Its true that payroll taxes wont be taken out of some taxpayers paychecks beginning Sept. Only the very last 1475 you.

FICA taxes consist of Social Security and Medicare taxes. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Estimate your federal income tax withholding.

Add up all your tax payments and divide this amount by your gross pay to determine the percentage of tax you pay. For example if your gross pay is 4000 and your. The employer portion is 15 percent and the.

What percentage of taxes are taken out of payroll. How It Works. For a single filer the first 9875 you earn is taxed at 10.

However they dont include all taxes related to payroll. What percentage is taken out of paycheck taxes. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or.

They take a big bite out of paychecks each month and just how big depends on where you live. What percentage of taxes are. If youre single and you live in Tennessee.

Without the help of a paycheck calculator its tricky to figure out what your take-home pay will be after taxes and other monies are withheld. Use this tool to. There is a wage base limit on this tax.

Like federal income and FICA taxes taken from your paycheck no matter which state you call home. There is a wage base limit on this tax. The rate jumps to 200 on income above.

For example if your gross pay is 4000 and your. The tax brackets in Montana are the same for all filers regardless of filing status. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or.

What Are Payroll Deductions Article

Irs New Tax Withholding Tables

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

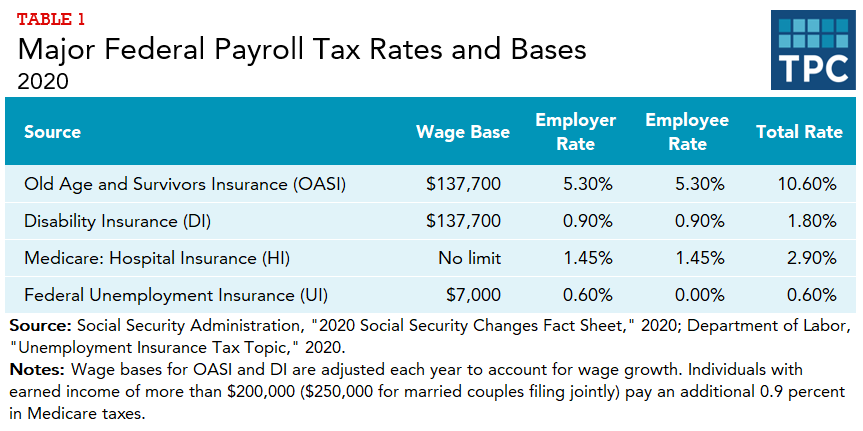

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Understanding Your Paycheck

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Paycheck Calculator Online For Per Pay Period Create W 4

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Calculate Taxes On Paycheck Top Sellers 53 Off Www Wtashows Com

Calculate Taxes On Paycheck Top Sellers 53 Off Www Wtashows Com

2022 Federal State Payroll Tax Rates For Employers

Calculate Taxes On Paycheck Top Sellers 53 Off Www Wtashows Com

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Paycheck Taxes Federal State Local Withholding H R Block